Mortgage rates are volatile, and can make a big difference in your monthly payments. Knowing what influences them can help you shop smart.

NerdWallet’s mortgage rate tables show sample rates from a handful of lenders. These are based on a hypothetical borrower with a 700 credit score and a 20% down payment, and do not include discount points.

1. Check Your Credit Score

A mortgage is one of the largest purchases most people will ever make. With that in mind, a low interest rate is critical to saving money over the life of the loan. To get the best rates, you’ll need to check your credit score and shop around.

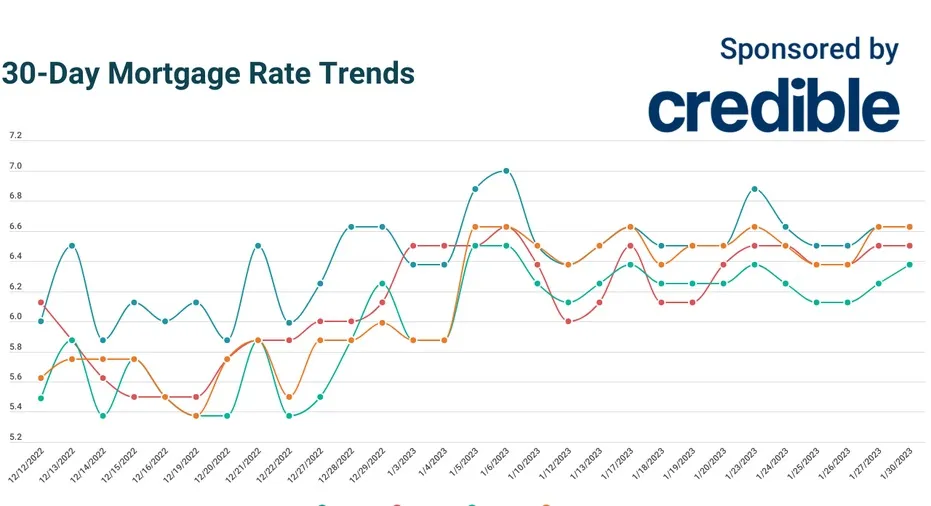

mortgage rates this week sank this week as investors waited to hear more about when the Federal Reserve might stop hiking interest rates. The average rate for a 30-year fixed-rate mortgage fell to 6.39%, down 0.04 percentage points from last week.

The good news is that the lower rates are making it easier for homebuyers to qualify for mortgages and refinance their current loans at better terms. In addition, lenders are now offering lower mortgage rates for borrowers with higher credit scores because they pose less risk to the lender that they will not be able to make their monthly payments on time.

If you are shopping for a mortgage, it is important to know that mortgage rates change daily and on certain days, they tend to change more than others. Typically, Mondays and Fridays are the most volatile days of the week for mortgage rates because they are often affected by economic news released on those days.

When it comes to mortgage rates, your credit score is the biggest factor in determining what you’ll pay. Lenders have settled on the FICO credit score as the most reliable indicator of whether a borrower will make their monthly payments on time. Borrowers with the highest scores will receive the most competitive mortgage rates, and if your score is low, you’ll need to take steps to improve it before you apply for a loan.

In addition to checking mortgage rates, you should also shop around with a few different lenders. The best lenders will offer a variety of loan options and rates to fit your situation, including adjustable-rate mortgages, VA and FHA loans, and even jumbo mortgages for homebuyers with larger down payments. In addition, you should compare loan fees such as application and origination charges, and the total cost of the mortgage over its entire term to find the best deal.

2. Talk to Your Lender

Getting the best mortgage rates can save you thousands of dollars over the life of your loan. That’s why it’s important to be a proactive shopper by regularly getting quotes from lenders and checking rates frequently. Ultimately, the interest rate you pay depends on factors like your credit score and financial situation. By understanding what determines a good mortgage rate and working to optimize your finances, you can maximize your chances of finding a great mortgage.

Your three-digit credit score is the biggest factor that lenders use to determine whether you’re a low-risk borrower. If you have a lower score, your lender may charge you a higher interest rate to compensate for the risk of lending you money. To improve your odds of qualifying for a great mortgage rate, work to raise your credit score before you apply for a home loan.

Another big factor that determines mortgage rates is your income. Lenders look at all your sources of income, including commissions, military benefits and child support. You can also lower your interest rate by choosing a government-backed loan, such as an FHA or VA mortgage. These loans have different requirements, but they can offer competitive mortgage rates for first-time buyers.

Other things that affect mortgage rates include economic factors, the Federal Reserve’s monetary policy and U.S. Treasury bond yields. However, you can’t control these influences and the only way to know which mortgage rates are best for you is to speak with a professional mortgage lender.

When shopping for a mortgage, it’s important to compare rates and fees from multiple lenders. You should also take into account other costs, such as property taxes and fees to determine the overall cost of a home. It’s also a good idea to consider a loan term that will fit your budget and lifestyle.

Finally, you should always ask about the mortgage interest rate and its APR (annual percentage rate), which includes both the interest and upfront loan fees. This will give you a true picture of the cost of your mortgage and help you compare apples to apples.

3. Shop Around

The mortgage rate is one of the biggest factors when borrowers consider their financing options. It will impact both their monthly payments and the total amount they’ll pay over the life of the loan. It can vary significantly from lender to lender, and even between the same type of mortgage. As such, it’s important to shop around for the best rates. Whether you’re looking at sample rates on lenders’ websites or using our mortgage rate comparison table, you can find the best rate for your situation by comparing national and local lenders.

Keep in mind that rates can change daily, and sometimes hourly, depending on market conditions. Because mortgages are often locked for 30 years, a small change in your interest rate can add up to thousands of dollars over the lifetime of the loan. As a result, it’s important to check the latest rates regularly and compare quotes from several lenders before making a final decision. Your mortgage broker or loan officer can help you stay up-to-date on current rates, and you can also track weekly changes in the market by logging in to see how mortgage rates are moving on Freddie Mac’s weekly survey. You can also compare rates with a free online calculator from Bankrate.

4. Make Your Down Payment

Mortgage rates are determined by several factors, and the borrower’s ability to control some of those factors can help them get the best mortgage rates. Borrowers can do things like improve their credit scores and make a sizable down payment, which may qualify them for a lower rate because the lender assumes less risk. They can also shop around for the best mortgage rate by getting quotes from lenders and comparing them to find the best one for them.

The mortgage market is a little slow right now because of fewer home buyers, but that doesn’t mean that homeowners can’t take advantage of it. Shopping around for a great mortgage rate is a smart move, even though it’s not always easy to do since rates fluctuate so much from day to day and lender to lender.

If you aren’t ready to buy your new home, it might be worth postponing house hunting for a while in order to clean up your financial house. Paying down credit card debts and other personal loans can raise your credit score, which in turn can lead to a lower mortgage rate for you.

You can use a mortgage calculator to estimate your monthly payments, including principal, interest, taxes, and insurance (PITI). By running different scenarios, you can determine how much of a down payment you might be able to afford, which may help narrow your search for a home.

When you’re shopping for mortgage rates, you should also consider the other loan details that are important to you, such as the length of the term and the origination fees and lender fees that will be charged when you close on your home. Additionally, it’s often wise to compare the rates for a conventional mortgage loan that is backed by Fannie Mae or Freddie Mac with those of an FHA or VA loan.

Generally, mortgage rates are higher for FHA or VA loans than they are for conventional ones. This is because those types of loans allow lenders to insure mortgages with less stringent requirements, and because borrowers can qualify for a loan with no down payment at all or with very low down payments.

Conclusion

If you’re looking to find the best mortgage rates this week, here are some tips to help you:

- Shop around: Comparing rates from multiple lenders is one of the best ways to find the best deal. Look beyond just the interest rate and consider factors such as closing costs and fees.

- Improve your credit score: Your credit score is a major factor in determining your mortgage rate. Take steps to improve your score by paying down debt and making payments on time.

- Consider different loan types: Different loan types, such as FHA or VA loans, may offer lower interest rates or lower down payment requirements that can help you get a better deal.

- Choose the right loan term: Generally, shorter loan terms come with lower interest rates, but higher monthly payments. Choose a term that works best for your financial situation.

- Work with a mortgage broker: A mortgage broker can help you navigate the mortgage market and find the best rates from multiple lenders.

Here are some FAQs related to finding the best mortgage rates:

- What factors affect mortgage rates?

Several factors affect mortgage rates, including inflation, economic indicators, global events, and the overall demand for mortgages.

- Should I go with the lender offering the lowest rate?

Not necessarily. It’s important to consider other factors such as closing costs, fees, and the lender’s reputation before choosing a lender.

- Can I negotiate my mortgage rate?

It may be possible to negotiate your mortgage rate with your lender, but it’s not always easy. Shopping around and comparing rates from multiple lenders can often help you get the best deal.

In summary, to find the best mortgage rates this week, you can shop around, improve your credit score, consider different loan types, choose the right loan term, or work with a mortgage broker. Be sure to consider all factors and compare rates from multiple lenders to find the best deal.