Interest rates are a key factor in determining stock market indices. Rising interest rates increase the cost of borrowing money and can negatively affect company profit margins.

Conversely, declining interest rates can push bond prices higher. Lower borrowing costs tend to increase company profit margins and consumer demand, which can boost stock prices.

Stock Prices

In general, stocks tend to rise when interest rates fall and decline when rates increase. However, the relationship isn’t always that straightforward because there are many other factors influencing stock prices and the economy.

Interest rate changes can also affect bond prices and the broader market. For example, rising rates tend to make bonds more attractive because investors receive a higher return for holding them. In turn, this can lead to a lower bond price and, ultimately, a higher stock price.

The Federal Reserve, the nation’s central bank, is tasked with keeping the country’s economy running smoothly. If the Fed thinks the economy is lagging, it can cut interest rates to help companies and consumers borrow money more cheaply. This typically encourages spending, which boosts the economy and stock prices.

Similarly, the Fed can raise interest rates to slow the economy and control inflation. When rates rise, businesses and consumers are more likely to save instead of spend, which can reduce the economy’s overall growth and hurt stock prices.

Stocks that produce the most income often outperform stocks that don’t, and that may have something to do with interest rates. Investors tend to favor companies that generate steady revenue streams, which means that their share prices can remain stable even when interest rates fluctuate.

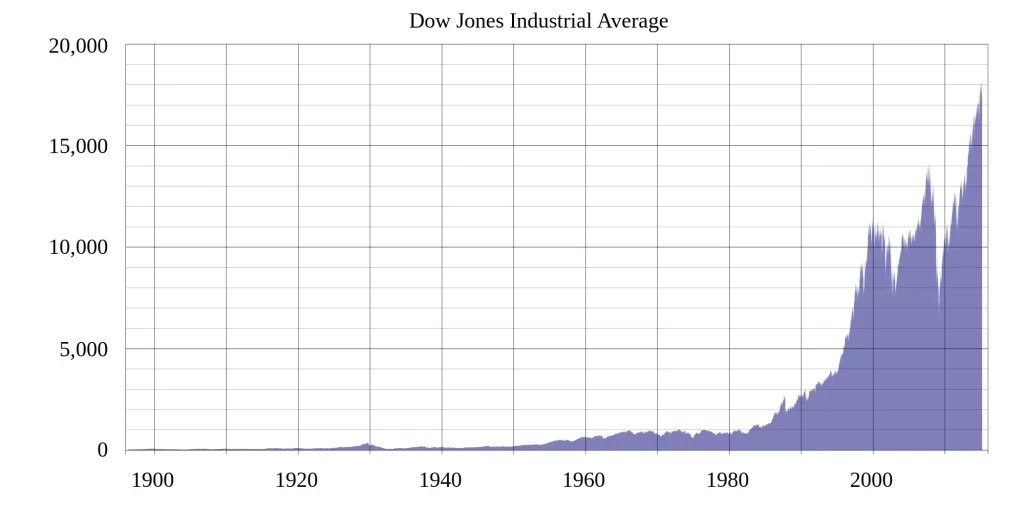

In addition, the stocks in the Dow Jones are grouped into sectors, and the index editors change this grouping periodically to reflect mergers and acquisitions or the evolution of industries. For example, the DJIA’s tobacco sector changed after Philip Morris bought out American Brands in 1985. At that time, the DJIA added Philip to double its number of tobacco stocks, and dropped American Brands from the list of components.

While the Dow Jones is a price-weighted index, other market indices are based on factors like size and weighting. These include the S&P 500, which is a market-cap weighted index that includes more than 500 stocks. The S&P also breaks down its constituents into different sectors. The Global Industry Classification Standard, or GICS, divides the markets into groups, with some of the groups being based on interest rates.

Bond Prices

Interest rates have a direct impact on bond prices. When the Federal Reserve increases interest rates, bonds decrease in value, all else being equal. When interest rates go down, bond values rise. This is because the lower interest rate makes future cash flows less expensive to discount when calculating a company’s valuation.

When a company or government issues a bond, it is contractually obligated to pay its investors the stated amount of interest over its set maturity term, or life. The bond’s price will also fluctuate depending on the prevailing market interest rates. In general, higher market interest rates cause bond prices to decline and lower yields.

The most significant factor in determining bond prices is the prevailing market interest rates. Normally, the longer a bond’s maturity term, the higher its yield, since investors are taking on more risk in lending their money for an extended period of time. This normal relationship between longer-term bond yields and their prices is reflected in the shape of the “yield curve,” which is a graph showing the yields for different bond maturities.

During times of higher inflation, the Federal Reserve tends to raise interest rates to slow the economy and prevent too much inflation. Inflation is the rise in the cost of goods and services, which can be driven by external factors or internal economic trends. The Fed seeks to keep inflation under 2%, which is considered healthy for the economy and a decent level of consumer price growth.

When the Federal Reserve cuts interest rates, it typically raises the yield for existing bonds and lowers the price for new bonds. This has the effect of lowering the cost of capital for companies, which can help them expand and grow their businesses. It can also give a boost to the stock markets, which benefit from cheaper borrowing costs. This is why the stock market usually rallies during periods of lower prevailing interest rates.

Interest Rates

Interest rates affect much of your daily financial life, from the amount of money you earn on savings to the rate you pay on a mortgage or car loan. But they also impact the stock market and broader economy. Falling rates stimulate growth by lowering the cost of borrowing, while rising ones slow it by increasing the price of loans.

The Federal Reserve controls most interest rates in the country, though other central banks may have their own rates as well. The Fed raises or lowers its Federal Funds Rate, which is the target rate it sets for banks to borrow funds overnight. Banks also have their own rates, such as the interest they pay on deposits and loans.

When the Fed increases its interest rates, the yields on Treasury bills, known as T-bills, rise. This makes risk-free assets, such as T-bills, more attractive and lessens the risk premium that investors demand for risky assets, such as growth stocks.

As a result, T-bills and other bonds outperform stocks. This is called the inverse correlation between interest rates and stock prices. When rates rise, stock prices tend to decline and vice versa.

Real estate investments are also sensitive to interest rates. Home builders, for example, see their share prices plummet when interest rates increase, which reduces potential buyers’ affordability and hurts sales. On the other hand, a low mortgage rate environment encourages homebuyers and boosts housing construction, which in turn boosts the share prices of companies that benefit from higher homebuilding activity.

Tech firms are also sensitive to interest rates because they often have a high level of debt that needs servicing. When interest rates increase, the expense to service this debt goes up, which hurts company earnings and lowers the multiple investors are willing to pay for a given unit of earnings.

Investors can minimize the effect of interest rates on their portfolios by diversifying. For example, a bond fund provides a fixed income stream and can help cushion the blow of changing interest rates. And if you want to hedge against inflation, consider Treasury Inflation Protected Securities, or TIPS. These bonds are indexed to inflation, so their principal and interest rises with inflation and falls with deflation.

Economic Growth

If interest rates fall, borrowing costs for banks, businesses and consumers will also fall. That tends to increase profit margins for companies and boost consumer demand, which can also help drive stock prices higher. The overall effect is one of economic growth, which is measured by the gross domestic product (GDP) figure for a country or region. This includes the value of all goods and services produced within a country during a particular period. In addition, GDP can be influenced by employment levels, housing market trends and consumer spending.

In a perfect world, the Federal Reserve works to keep inflation between 2% and 3%, which helps sustain an economy in which people are working and buying goods and services. However, the economy isn’t always in perfect shape, and factors outside of the control of the Fed can cause inflation to be lower or higher than this target.

The Federal Reserve raises its own rate when it feels that inflation is getting out of hand, which then tends to push other interest rates up, too. For example, when the Fed increases its discount window rate, that often forces other banks to raise their own rates on loans.

But if the Federal Reserve doesn’t feel that inflation is a danger, it might choose to lower its own rate to encourage economic activity. This can help to keep unemployment low and encourage consumer spending, which both boost GDP.

Another way that the Federal Reserve can affect the economy is by purchasing bonds and other financial assets. This acts to mechanically push up prices for these assets, because investors want to invest in something with a relatively stable return. This also helps to keep the value of the dollar strong, which can have a positive impact on other nations’ economies and their own currency values.

Companies that are largely dependent on consumer spending are most sensitive to changes in interest rates. For example, homebuilders and mortgage lenders may see their profits plummet if they have to pay higher rates on their loans, which can discourage people from buying homes or cars.

Conclusion

Interest rates can have a significant impact on the Dow Jones Industrial Average (DJIA), as changes in interest rates can impact corporate profits, borrowing costs, and investor behavior.

When interest rates are lowered, borrowing costs for corporations decrease, making it easier for them to invest in growth and expand their operations. This can lead to higher corporate profits and potentially higher stock prices, which can drive up the DJIA.

On the other hand, when interest rates are raised, borrowing costs increase, which can reduce corporate profits and cause stock prices to decline, potentially leading to a decrease in the DJIA.

Interest rates can also impact investor behavior, as higher interest rates can make alternative investments such as bonds more attractive compared to stocks, potentially leading to a decrease in demand for stocks and a decline in the DJIA.

It’s important to note that interest rates are just one of many factors that can impact the DJIA, and that other economic indicators and geopolitical events can also play a significant role.

FAQs:

Q: How do lower interest rates impact the DJIA?

A: Lower interest rates can reduce borrowing costs for corporations and lead to higher corporate profits and potentially higher stock prices, which can drive up the DJIA.

Q: How do higher interest rates impact the DJIA?

A: Higher interest rates can increase borrowing costs for corporations and reduce corporate profits, potentially causing stock prices to decline and leading to a decrease in the DJIA.

Q: Can changes in interest rates impact investor behavior and the demand for stocks?

A: Yes, higher interest rates can make alternative investments such as bonds more attractive compared to stocks, potentially leading to a decrease in demand for stocks and a decline in the DJIA.

Q: What are some other factors that can impact the DJIA?

A: Other factors that can impact the DJIA include economic indicators such as GDP and employment data, corporate earnings, geopolitical events, and government policies.